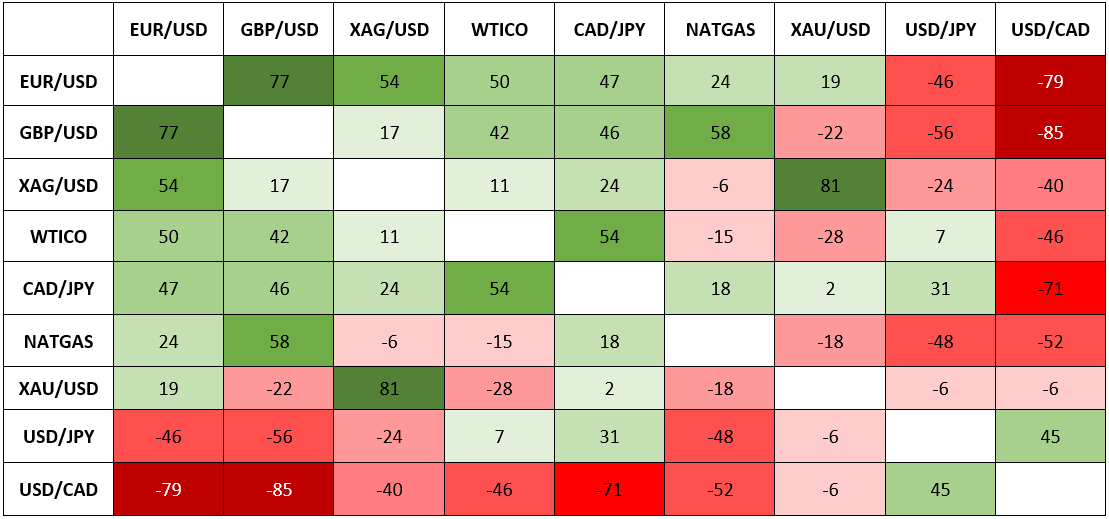

How the correlation between currency pairs works The correlation between currency pairs is a very interesting topic for investors in the currency market. Correlation between currency pairs indicates how similarly two currency pairs move in the market. There are different types of correlation, such as positive, negative and neutral correlation . For example, the […]

Technical Analisi

Swing Trading: The useful strategy for beginners and experts You will know that brokers offer trading strategies from time to time through their newsletters. Of course brokers are always biased, but often their information can be used to our advantage by stripping it of superfluous bits. This time we talk […]

Scalping Strategy M1 / M5 with Macd and Stochastic If you prefer trading with minimum risk and short deadlines, here is a simple scalping strategy suitable even for the less experienced, the Macd + Stochastic turbo strategy. You probably already use an indicator, perhaps one popular among traders such as […]

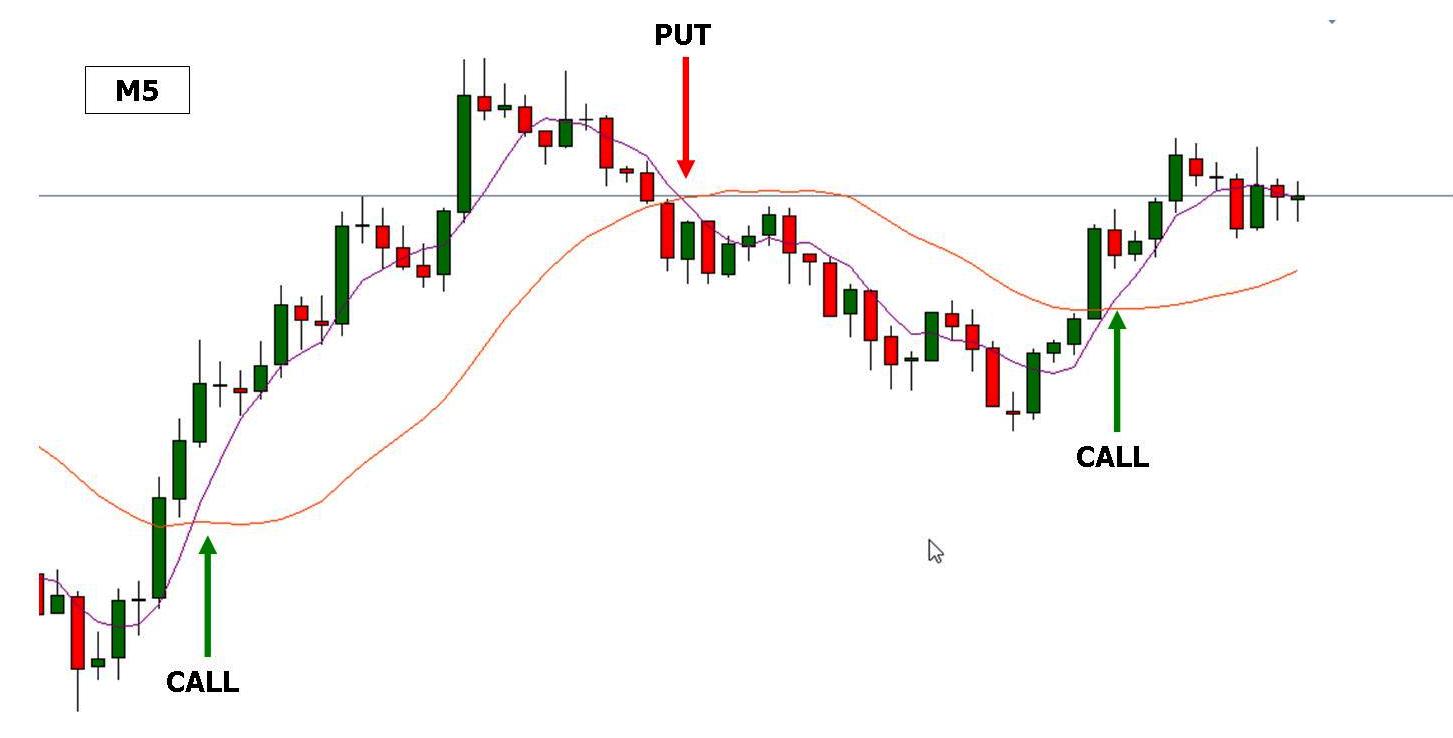

The Moving-Average Crossover Strategy The Moving Average crossover strategy is of vital importance for any beginner simply due to its straightforward and proven effectiveness. Even for traders learned and experienced through a myriad of other various systems, some of which complex, can find solidarity in returning to this simple system of immediate use, appreciated […]

SR Arrows Breakout Indicator Free Download This “SR Arrows Indicator” displays support and resistance levels with an arrow to appear at the breakout, i.e. after the candle has crossed the line. A simple and useful tool. Who is the trader who does not use static resistance and support levels? This […]

A strategy based on trend that can give great satisfaction to the trader. Looking at the performance of prices in various charts, especially those with higher time frames, it is not difficult to visually detect the direction of the market. This allows us to recognize the trend and use it […]