CROSSING OF TWO MOVING AVERAGES

After the article dedicated to how to implement a strategy based on a moving average , this time we evaluate whether two moving averages further improve our method.

Let’s see how to use the crossing of two EMA averages, setting the correct parameters and identifying the moment of opening the position.

In the past, we had already produced a large service on the subject of the two averages and their intersection, to which we refer you for further information.

IQ Option is sharing a tutorial on this topic. We have resumed it in our own words, without invitations to trade or advertising. We will also review some technical concepts.

The previous moving average tutorial demonstrates how easy and practical it is to use. Let’s see what happens by applying two moving averages, how to set them and when to receive a signal to open a position.

According to what we read in various technical articles, two averages should give more precise results. Let’s see in this article.

The average indicator is based on the calculation of the average price on the chart, obtained by setting a suitable time period. With two indicators (two MAs), therefore two averages adjusted over different periods, it may be possible to evaluate more precisely when to make trading decisions.

Let’s go back to the concept of Mobile Media.

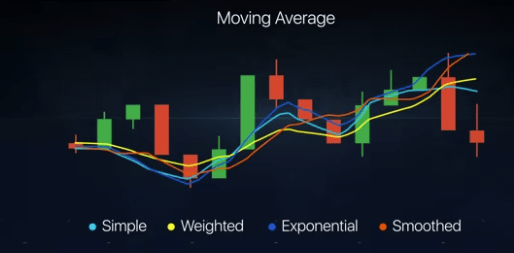

The Moving Average indicator indicates the direction of an asset’s price.

The average is measured according to the number of candles considered, calculating the average of their closing values.

Example, an average calculated over 5 candles divides the closing values by 5.

If the graph goes ahead by a new candle, the indicator will redo the calculation on the most recent 5 candles, and so on, drawing a line in the graph based on the values obtained, which therefore indicates the current trend.

If we increase the number of candles taken into consideration, the sensitivity decreases, but the delay of the graph increases.

The intersection of two averages each based on different candle intervals (periods) helps to evaluate any trend reversals.

Instead of the simple moving averages seen here we will use exponential moving averages , which operate mainly considering the most recent values. If you want to know more, look for the complete definition and meaning.

The double moving average

The method involves two exponential moving averages (EMA) set with two different periods: 100 and 14 . Thus the trader trades with a highly adaptive 100 EMA, which reflects the market movement on a larger scale, and a faster 14 EMA, which reacts to the short-term trend.

SETTINGS

First look for the indicator in your broker’s charting platform list. The averages are present in practically all the trading room.

For example on Pocket Option :

About IQ Option:

In our technique we will have to enter two averages . Select the type of average, EMA, with a period of 14 and another with a period of 100 . Change the color of the line, for better viewing.

Same settings regardless of the selected time frame.

RULES FOR POSITION OPEN SIGNALS

Sell signal (PUT) (example on Pocket Option chart above). The 14 EMA is above the 100 EMA and they cross each other. After the crossing the EMA 14 is below the EMA 100. Wait for a retest of the chart and open the position at the close of the first red candle:

Purchase signal (CALL) , in case of opposite situation (example in IQ Option chart).

After the crossing, the EMA 14 is above 100. Before entering, wait for the price to retest the EMA 14.

Entry at the close of the first green candle:

In conclusion, the double moving average crossing strategy requires minimal setup, but is able to offer the trader a lot of information on the direction of the trend. Always make your own experiences in demo first. Happy trading.

We remind you to read/participate in the discussions on Telegram channels:

Broker No-Esma: https://t.me/BrokerNoEsma

Pocket Option Italia: https://t.me/PocketOptionItalia