The best deadline of the trade: which one do we choose with binary options?

The best expiry in binary options. The trader who fails to predict the direction of prices at expiration risks losing the invested capital .

Premise

The best expiry in binary options

Let’s say right away that there is no precise best expiry for binary options.

This can only be indicative , and the rule applies to any strategy where the deadline is not clearly specified.

Despite this, let’s see how to identify an acceptable deadline for our entry into the trade.

It is useless to have a valid strategy if the operation is then lost on the basis of a wrong choice of expiration.

The Best Deadline and the Time Frame are linked together.

![]() The Time Frame indicates the duration of a candlestick in the price trend chart.

The Time Frame indicates the duration of a candlestick in the price trend chart.

M1 one-minute candles, M15 15-minute candles, etc.

The graphs look different depending on the time frame and an initial indication of expiry can be established based on the aspect of the graph .

Operating on M1 , for example, we certainly cannot choose a one-hour expiry, given the unpredictability of price trends in the short term.

Rule 1. Choice of time frame

The best expiration depends on the type of time frame, usually 5-6 times the time frame , i.e. a development of 5-6 candles.

This is an assessment that is based on experience and is valid for most cases where a precise deadline is not specified.

With M1 the best deadline will be around 5 minutes.

M5 about 30 minutes.

M15 about 1 hour – 1 hour and a half.

etc..

It can be seen that using high time frames the expiration distances itself over time.

Some traders prefer to be able to make several daily , or even hourly (scalping) entries; for this reason, sometimes low TFs are often used, from 1 to 15 minutes, even if it is known that higher time frames give greater guarantees.

However, larger time frames must be kept in mind. Not for deadlines (if we are operating on low times) but for checking the trend and the entry signal.

In fact, strategies often also refer to the observation of higher time frames.

Rule 2. Evaluation of swings

Another approach is based on the distance between a maximum and a minimum , i.e. between an upper and lower peak of a swing (oscillation). The consideration to be made is this:

Observing a graph, you always notice price fluctuations .

EUR/USD price swing observation (Zig-Zag indicator)

What seems like a continuous push in a certain direction then turns into a reverse process.

Since a strategy is often based on technical considerations which foresee a change of direction at a certain moment , we should know how long this reversal will last, and we cannot know it precisely.

So we need to take a cue from what has happened during the most recent price movements .

Expiration based on fluctuations

Are we able to estimate how long the price swings last on average?

We measure the time between a maximum and a contiguous minimum , or between a minimum and a maximum, identifying the main and most significant ones. This is basically equivalent to counting candles.

- Is there a range of around 10 candles on M5?

Then the expiry will be around 45-50 minutes (10 candles x 5 minutes = 50 minutes), or as close as the broker allows.

- On M1 a range of 15 candles?

Then the deadline is 15 minutes (but never less than 5 minutes).

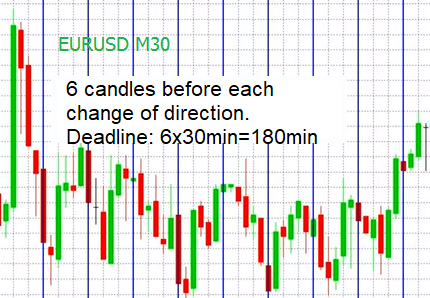

On M30 a range of 6 candles? Expiration 180 minutes 3 hours, if provided by the broker, or the closest.

On M30 a range of 6 candles? Expiration 180 minutes 3 hours, if provided by the broker, or the closest.

As can be seen from the graphs there is sometimes a foreseeable short-term fluctuation .

Assuming to enter a maximum or a minimum, the duration of the fluctuations gives an approximate but sufficient indication to make an expiry decision.

The expiration in binary options therefore depends on the time frame and the duration of the recent price swings.

In the event that it is not possible to determine a more or less repetitive swing, it is necessary to refer to Rule 1.

It should also be noted that this visual system can also be used to enter a trade , however the moment of purchase of an option depends on the signal given to us by our strategy, the moment of the entry signal which often does not correspond to the peaks of the oscillations.

In this case the evaluation must be made at the moment of the signal.

Conclusion

Ultimately, the elements to be evaluated for the correct deadline are:

-

The Time Frame

-

Rule 2 (or as a second option Rule 1.)

-

The entry signal of the strategy

As a suggestion for the evaluation of the best expiry, the Zig-Zag indicator already present among those supplied on metatrader can be of help.

It can be seen from the image above (Eur/Usd M5), where we have inserted the Zig-Zag indicator, the fluctuations repeat cyclically giving us the possibility to choose, even if with a certain approximation, the best expiry for our trade on binary options.

Of course the appearance of the Zig Zag will depend on the settings. The trader will keep the default one or choose on the basis of a visualization of sufficient clarity of highs and lows.