Support and Resistance: let’s make use of them! horizontal levels of support and resistance Many already know what support and resistance levels are, but often used simply as reversal zones they lead to disappointing results. We must be clear if and when they can be used to open a position. So […]

Indicators and Strategies

NON Repaint Alert Arrows indicator For autotrading systems like MT2 or manuals referring to Metatrader. The non-repaint indicator that we offer was created by forzaforex.it for the need for automatic trading with arrows, but it can also be installed on Metatrader 4 for manual use. It is called the “ Alert Arrows Non Repaint ” Indicator. Being […]

Martingale What is the Martingale strategy? The idea of the Martingale strategy is to counteract the losses caused by lost trades. In standard Martingale, if you lose a trade, you re-enter with a greater trade amount, so that over time, a winning trade will compensate all the previous losses. This […]

Automated Binary Options Trading. Not just a robot You can: Automate your MetaTrader 4/5 arrow indicator signals Trade manually on your MetaTrader 4/5 live market charts CopyTrading: Trade like the experts without being one Let’s start with the most important one, the one for automated trading. MT2 Automated Binary Options […]

FreeBinaryOptions.one presents: The Fisherman’s Strategy The free trading system suitable for everyone Note: We remind you that the PDF attached to the strategy is available at the end of the page and can be downloaded free of charge. The already set indicators are logically attached in the full version. Attention: If […]

Bollinger Bands + RSI Strategy RISK WARNING: Your capital may be at risk The Bollinger Bands RSI trading pattern is perhaps the most respected trading system .In this system , ForzaForex.it illustrates complete trading rules which are added to those commonly found in normal tutorials and which give a greater guarantee of success. Bollinger […]

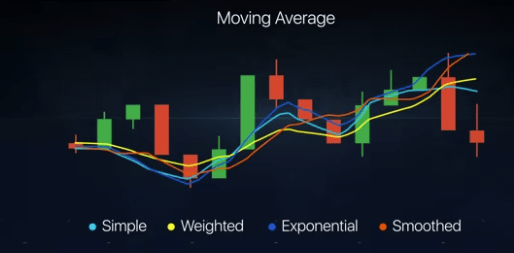

The Bollinger Bands. One of the most used binary options trading indicators. But are Bollinger Bands still useful? How do they adjust? Alone or with other indicators? We have already recently talked about trading based on a moving average and then on two moving averages.If we wanted to use 3 moving averages, we could install the Bollinger […]

CROSSING OF TWO MOVING AVERAGES After the article dedicated to how to implement a strategy based on a moving average , this time we evaluate whether two moving averages further improve our method. Let’s see how to use the crossing of two EMA averages, setting the correct parameters and identifying the moment […]

MOVING AVERAGE STRATEGY Does it still make sense to use it? Does it give hints about the future? Are prices bouncing? Why is it called moving? How are the parameters adjusted? Answers to these and other questions in this article. Memorandum. What is a Moving Average? The moving average (also called […]

“GOwithGREEN” Auto-Open position: without robot or broker’s authorizations Here is an example of a trading session without manual operator intervention. Automatism will accomplish this by itself, awaiting for the appropriate conditions to open your trade accordingly. The method involves acquiring an entrance opening by taking advantage of the delay in […]

RSI DIVERGENCE PRICE ACTION STRATEGY The best trading system for binary options with Divergences, SR, Trendline, Time Frame, Correlations. INTRODUCTION The RSI is one of the best known and most used indicators, but we all know that there is no such thing as a “magic” tool. RSI is also no […]

Learn the 10 Most Popular Indicators MetaTrader in 10 Minutes Given its importance, we recommend that you save this page as a favorite. For convenience you can download the free PDF (form at the end of the article) and keep it for ease of reference. Those who approach the world […]